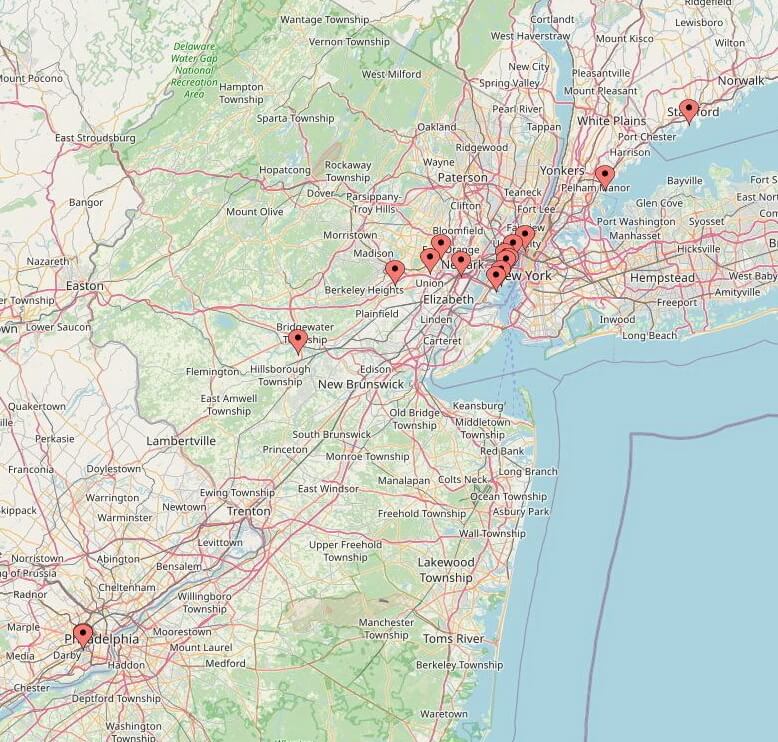

Since its inception in 2014, Invel Capital has successfully executed a broad spectrum of value-add strategies, including off-market and distressed property acquisition, note acquisition, litigation workout, land assemblage, gut-renovation and repositioning of multifamily and mixed-use properties throughout the Northeast region.

Invel’s investment principles combine a disciplined adherence to conservative underwriting standards with a creative, entrepreneurial approach to deal sourcing and value creation. Invel makes investment decisions selectively and on the basis of fundamental analysis, sophisticated financial underwriting, rigorous market research, and extensive due diligence.

Below is more information on our track record, acquisition strategy and investment parameters.